The world’s second-largest cryptocurrency network, Ethereum (ETH)

$ 2,789, is reaching a significant turning point as it garners increasing interest from institutional investors. A report by Bernstein, released on June 9, emphasizes that while Bitcoin (BTC)

$ 109,761 has emerged as the preferred “store-of-value” narrative, Ethereum and other public blockchains are spearheading genuine financial innovation in the latest market cycle. Although analysts remain committed to a $200,000 target for Bitcoin, they assert that the real growth will accelerate on Ethereum, propelled by applications such as stablecoins and asset tokenization. This transition is further underscored by an inflow of $815 million into U.S.-based spot Ethereum ETFs over the past 20 days.

Growing Institutional Interest in Ethereum

Spot Bitcoin ETFs, introduced to the market in January 2024, have amassed over $120 billion in assets, becoming one of the most successful investment products ever. By contrast, spot Ethereum ETFs, launched in July 2024, currently possess a relatively modest volume of $9 billion. However, considering Ethereum’s market capitalization is one-seventh that of Bitcoin, this discrepancy is justified. Notably, net inflows to Ethereum ETFs have climbed to $658 million since the start of the year. The heightened demand in the past three weeks indicates that institutional investors are revisiting their interest in ETH.

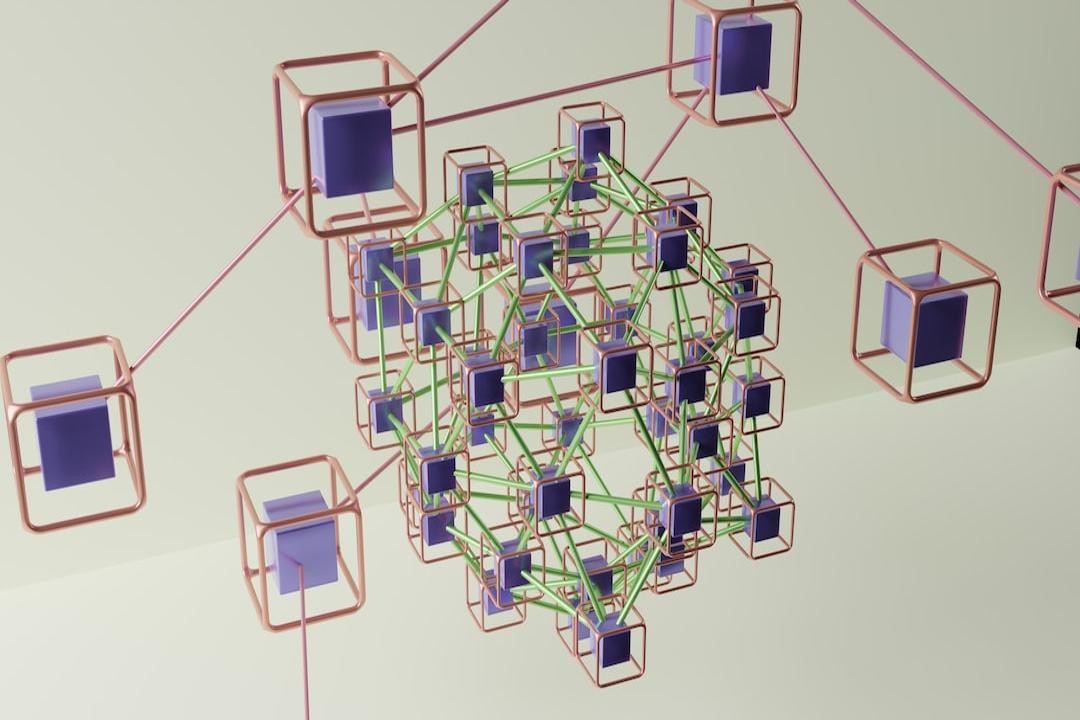

Bernstein argues that Ethereum, with its identity as a “global decentralized computer,” naturally serves as the foundation for new financial products. A majority of stablecoin and tokenization projects are already Ethereum-based, and the network fees paid for these transactions directly enhance ETH’s value. Analysts claim that the notion of “useful blockchains, useless cryptocurrencies” is losing its validity, as transaction fees are reflected directly on the Ethereum network and subsequently on ETH’s price.

Accelerating Innovation with Payment and Fintech Strategies

Payment giants like Visa, Mastercard, and Stripe are advancing their stablecoin strategies, while cryptocurrency exchanges such as Coinbase and Kraken begin to offer new financial services on Blockchain. Coinbase is piloting merchant payments using stablecoins on its Base Layer-2 network, while Kraken plans to offer tokenized U.S. stocks to international users. Robinhood is actively advocating the concept of tokenizing real-world assets.

According to Bernstein, these initiatives signify a shift from speculative coin games for retail investors to capital markets, payments, and next-generation fintech applications. As more companies leverage Blockchain rails, network fees will rise, with earnings directly impacting Ethereum’s primary network asset, ETH. Analysts foresee a self-sustaining cycle, noting, “Foundational Blockchain assets have transitioned from pointless speculation to tangible financial innovation, drawing significant investor attention.”